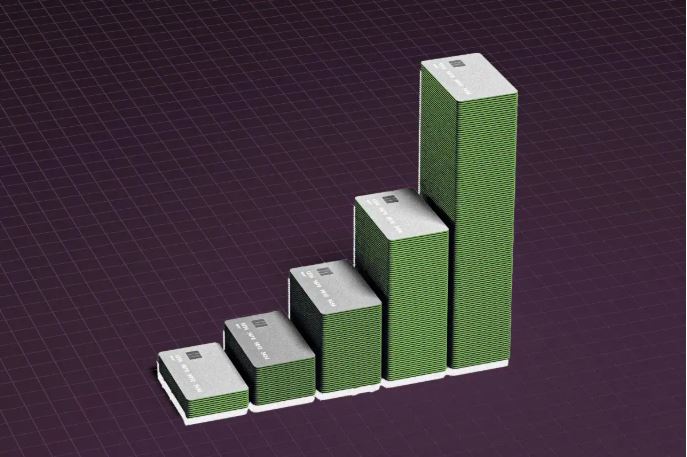

The Surge in Premium Credit Card Annual Fees

In recent years, credit card issuers in the United States have steadily increased the annual fees for top-tier cards, signaling a dramatic shift in the premium credit card landscape. Cards that were once considered luxury perks are now approaching $1,000 in yearly fees, with issuers targeting affluent consumers seeking exclusive rewards, elite travel benefits, and unmatched concierge services. American Express recently raised its Platinum Card fee from $695 to $895, while Chase Sapphire Reserve now commands a $795 annual fee. These adjustments reflect a broader trend in the industry: high-value, high-fee cards are becoming mainstream among premium offerings.

What Consumers Receive for Premium Fees

The justification for these steep annual fees lies in the exclusive benefits and services offered. Premium cardholders gain access to airport lounges worldwide, extensive travel insurance coverage, elite hotel perks, and priority concierge services. Additionally, these cards often include significant cashback, travel points, and redemption options that far exceed what standard credit cards provide. Issuers emphasize that for frequent travelers or high-spending consumers, the tangible value derived from these benefits can far outweigh the hefty annual fee, making the investment worthwhile for a select demographic.

New Entrants in the Premium Card Market

Recent industry moves illustrate how competition is driving fee increases. Citi introduced the $595 Strata Elite card in July, adding to the growing list of premium cards with fees approaching four figures. As issuers seek to differentiate themselves, the value proposition shifts toward offering ultra-exclusive experiences, creating a market where consumers are willing to pay a premium for access to services unavailable with standard cards. Analysts predict that as more financial institutions enter this segment, annual fees could surpass $1,000 in the next five years, barring regulatory or macroeconomic constraints.

Economic and Market Factors Influencing Fees

Macro trends, including inflation and rising operational costs, contribute to escalating annual fees. Issuers balance the cost of delivering high-end services with the expectations of wealthy consumers who demand seamless experiences and personalized support. According to industry expert John Cabell from J.D. Power, the premium card sector is evolving into a market where high fees are no longer exceptions but the standard for elite financial products.

Navigating the New Premium Card Landscape

For consumers, understanding the trade-off between annual fees and benefits is critical. While the $1,000 annual fee threshold may seem daunting, those who leverage rewards effectively, particularly frequent travelers and high spenders, can maximize value through travel perks, exclusive experiences, and elite status benefits. The premium card market is no longer a niche; it is increasingly the norm for affluent cardholders, reshaping expectations for credit card rewards, services, and annual costs.

The future of premium credit cards suggests that high annual fees will continue to rise, with exclusive rewards becoming the key differentiator in an increasingly competitive financial landscape.